I’ve been sick of him from the first moment I met an adherent. I mentioned how I like to avoid debt and pay it down early and the person said “Oh, so you listen to Dave Ramsey?” I confessed to having no idea who they were talking about, and they swore that I was being obtuse because I couldn’t have come up with “interest sucks” on my own.

Those who are undereducated often can’t imagine that people can be truly brilliant.

Interest bad is far below brilliant

I guess we could be grading on a curve of people that view Ramsey as brilliant…

George Washington bemoaned debt

Finance

gurugrifter Dave RamseyFTFT.

I like to imagine this means “fixed that for thee.”

“fiance guru” isn’t a real job. Fight me.

Finance guru vs. Jiu-jitsu guru…

Dave “I fire people that have sex out of wedlock” Ramsey? Who cares what that religious nut have to say?

I’m a gen x, and I don’t want to work. I mean really, who does? Who would rather work than spend time with their family and/or see the world? I work because I have to to survive.

This guy was born into a wealthy family and acts like he earned it all

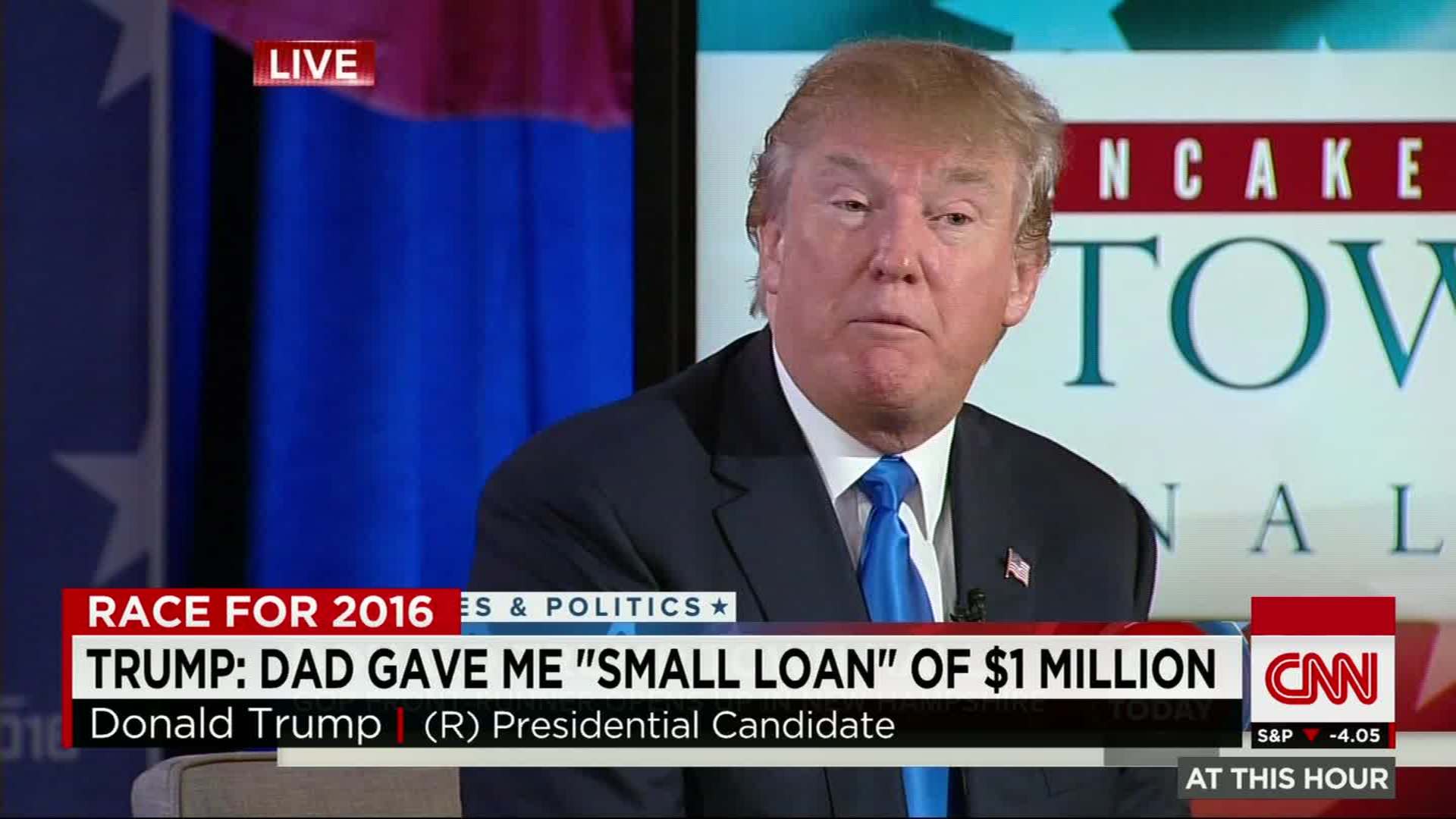

Big Trump energy.

They always do. Its frustrating and disgusting.

We really need to start eating the parasites that talk like this. This fucking shit stain has never worked a day in it’s pathetic little life.

Ramsey was born in Antioch, Tennessee, to real estate developers.[2] He attended Antioch High School where he played ice hockey. At age 18, Ramsey took the real estate exam[2] and began selling property, working through college at The University of Tennessee, Knoxville,[2] where he earned a Bachelor of Science degree in Finance and Real Estate.[3]

Daddy gave him all he’s got and yet it’s my fault my dad was a poor artist and died young?

eat my whole asshole Ramsey

It’s always people born to wealth who feel the most entitlement.

What part of that says “got his money from his dad”?

It says he sold property to put himself through school at age 18.

My dude what 18 year old do you know that owns property?

He’s born to real estate developers, probably helps tremendously with connections

Do you have any recipes for cooking human flesh, since you espouse cannibalism? I’m just wondering if you’re prepared to practice what you preach.

I don’t think you need specific recipes for cooking human flesh, I would think any recipe used for pork would be pretty 1 to 1

Dave Ramsey sounds like someone who has forgotten what happened last time.

Dave Ramsey can fuck himself. This is the same idiot that says you should give 10% of your money as tithe so that an invisible sky daddy doesn’t send you to hell to burn for eternity.

While sitting on a golden throne he made from daddies money telling other’s how to live.

Daddies money? He was literally bankrupt when he had his daughter and rebuilt everything.

Do you know what bankruptcy does?

It doesn’t mean you have nothing. It’s designed to stop your creditors and protect what you have.

He didn’t start from scratch my dude.

Defending billionaires online is PATHETIC.

I lost all respect for Ramsey when I came across a video of him saying he wouldn’t take a 0% interest million dollar loan. His opinions on finance are outrageous and dumb.

His whole thing is being anti-debt which is probably good for some people, but some people already have no debt

Debt comes with interest. If you don’t have to pay interest it’s free money.

Eat the rich.

I’m fine with just throwing them in a wood chipper, personally.

Feet first, of course.

We could study the psychological effects of watching one’s limbs being fed into a wood chipper.

Y’know…for science.

We should teach the millionaires to fear again

I’ve always made good money, and got some good advice when I started my first job to just always put aside 10% for saving, and put that into ira/401k. I’m in my 40s now and a millionaire. I still have to work and will until retirement age.

I know I’m lucky, but you’re really barking up the wrong tree if you think simply having a million dollars makes you bad person. I’m just a saver.

Ok then let’s teach the billionaires to fear again.

Or you can start saving and investing when you’re young and be a millionaire when you retire. Compound interest is magic.

…what’s the point of becoming a millionaire when I no longer have the same energy as I used to when I could still enjoy things?

This is a really cute concept. Many people don’t have an extra $5 a day. Do you know what you get when you invest $5 a day over 12 years at a 4% interest rate? It’s not a million dollars.

Saving what, exactly? The problem is that people arent able to maintain a standard of living, meaning they can’t certainly can’t save.

Or in simpler terms, things are becoming so expensive that they are forced to decrease their standard of living to meet their needs. This isn’t a personal finance issue.

Question is, was that standard of living with in their means in the first place, Americans are in 1 trillion of credit card debt. That’s insane to me, we have a spending problem that is now seemingly worse because everything is expensive.

When you’re already more or less locked in to a lifestyle and then hit with record inflation, not everyone is going to just cancel their lives and live like a pauper, especially families. Yes many people are grossly irresponsible with credit card debt, but that isn’t the story for everyone. You’d have to be living under a rock to not see how insanely expensive life has become in the last few years. Sure people can sell off all of their possessions and move to Nebraska, but that isn’t a reasonable solution.

I hear yah, personally I cancelled a bunch of streaming apps, making all my food and coffee at home and been hitting thrift stores and estate sales for things I need. I know shits expensive, my car is a 2006 and it eats gas but I’m not falling for the new car trap.

Just get a small loan of a million dollars

Ramsey did not get rich from a $1 million loan.

He got rich by having $1.2 million in loans. Declaring bankruptcy, then building a financial media empire that teaches people to get rich by avoiding all debt; buying his books; attending his classes; and investing with financial advisors whom his organization carefully vets to assure that their kickback checks clear.

I was referring to Trump on this one.